Eye-Wateringly High Energy Prices #ENERGYCRISIS

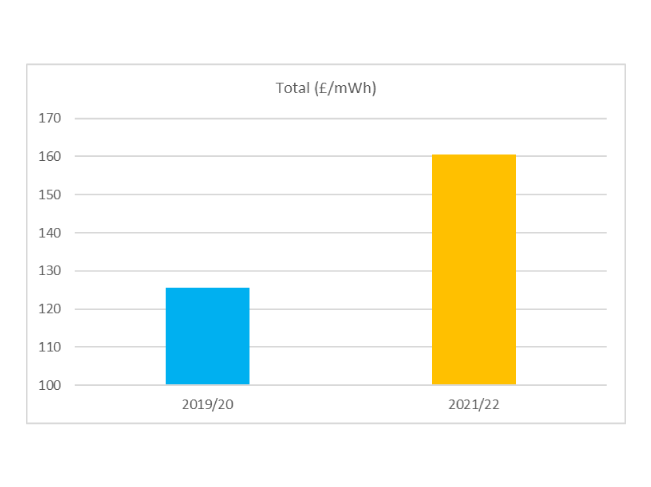

It is truly amazing what is occurring across Energy Markets at the moment, just when we think that prices cannot go any higher; the market responds with another knockout blow.

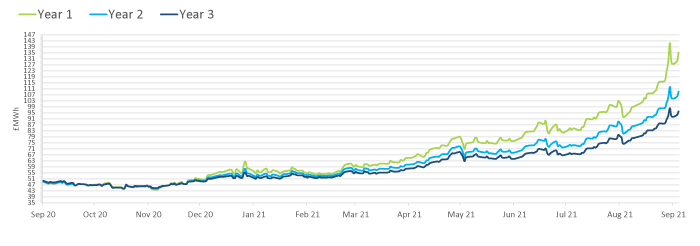

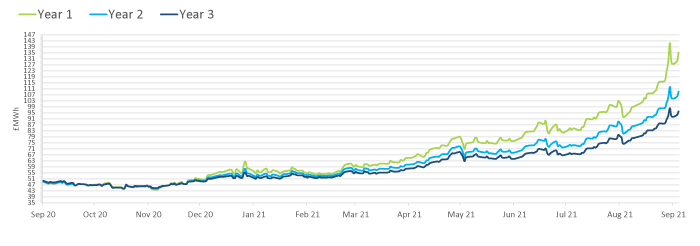

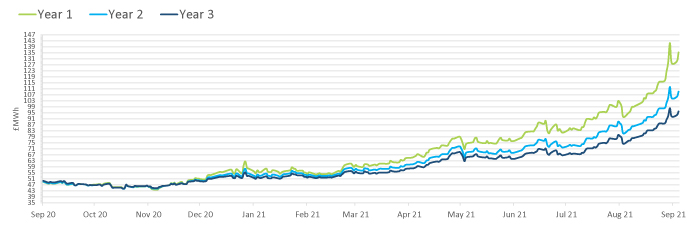

Electricity Market

As we are all aware, Markets rose furiously last week as supply concerns engulfed markets. There was incredibly, a bearish rebound after markets absorbed the bullishness and provided traders with some optimism: Increased Wind Generation in week 38, increased Norwegian flows and the arrival of LNG Cargoes to the UK in late September.

This bearish rebound simply only papered over the cracks, with offers remaining eye-wateringly high. This incredible volatility and high-price levels has claimed casualties and will continue to do so.

The bullish trend returned yesterday with Russia’s Gazprom booked less than half of the natural gas transportation capacity offered on the Yamal Pipeline from October (30.75 mcm/d out of 87.2 mcm/d) with offers increasing across the curve, with Gas Markets pushing to higher levels is a chaotic day of trading.

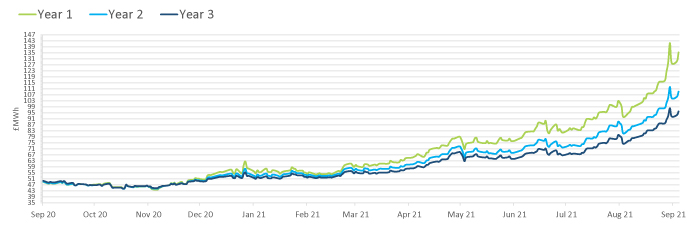

Gas Market

European Neighbours

With Energy Markets now on headline news and politicians now involved in discussions with the sector, Markets will have a ‘Hysteria Premium’ attached which simply adds to the volatility. A lot has been discussed in recent days about the UK Market, but let’s delve into the Global Market.

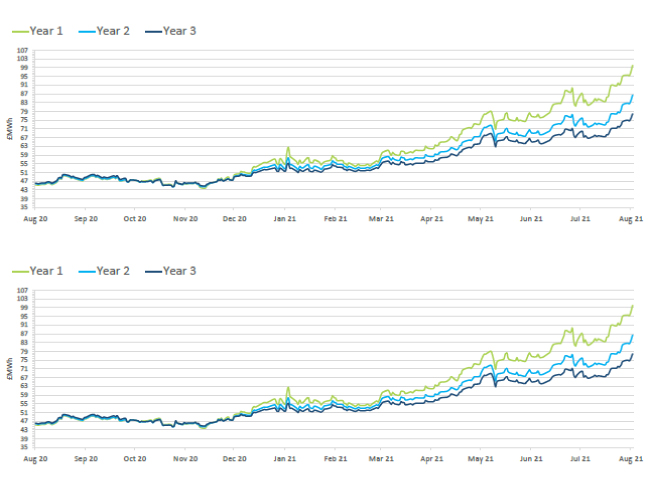

Firstly, our European neighbours; where it must be said that on average their Energy Bills are 30% Cheaper than the UK, but it could be argued that they are in a slightly worse position that the UK currently.

A quick look through Storage Levels, would see the UK at a healthy 90% of Natural Gas Storage, whereas Germany is at 63% and as a result German Wholesale Energy Prices have risen by 50% in September alone.

EU Countries have been swift to act though, with Spain already announcing measures last week, France introducing subsidies for households, and an expected €4.5billion support package for households to be unveiled in Italy later this week.

This price volatility in Europe/UK has many factors; firstly, a bitterly cold winter in 2020 where stock levels plunged; this stock which would usually start to be replenished in April saw Gas Demand soar during the month as unseasonably low temperatures hit.

Secondly, Russia has continued to refuse to increase flows on the ‘Spot’ (this idea that flows are increased as and when it is need) rather by continuing to supply via advanced quotas. There are levels to this also, one being increased Gas Demand in Russia itself and, possibly more interesting news-wise, Russia could be limiting output in a bid to force the European Commission’s hand into agreeing the commercial operation of its Nord Stream 2 Pipeline.

Also, the EU/UK has been priced out of the lucrative Liquified Natural Gas Market by its Asian competitors. LNG is used to re-fill storage levels on a wider scale, however, there has only been a small number of deliveries to the continent over the last 6 months.

Asian Markets

This leads well onto the Energy Market in Asia, which relies heavily on LNG to meet its demand needs. Demand has soared in the region as countries exit harsh lockdowns and population growth in the region remains high. This has led to Asian LNG Markets to contain a huge premium compared to European Offers, therefore cargoes initially heading for Europe are turning around and heading back to Asia where to prices are higher.

Essentially Asian Markets have no alternative than LNG, so traders are willing to pay more than their European/UK Counterparts in order to meet with demand. Also, there would still be a heavy Coal influence on Power Generation in Asia, and as you can guess, Coal Prices are at record highs as well as Carbon Markets, so this pushes Asian LNG Prices up further as it becomes cost negative to use Coal for production.

United States

Indeed, the United States could be a major beneficiary of this price war, since the Obama Administration the US has been flexing its Energy muscles with US Exports of LNG now at a very high level with cargoes hitting the lucrative Asian Market as well as South American markets at an all-time high price. Yet, the US has still seen a 120% increase in Gas Costs this year; substantially lower than Europe but still a large increase however you look at it. A key point about the US though is that Gas Users tend to be heavy industrial premises rather than households so the impact on the general public isn’t as dramatic.

Stagflation

The key area that markets will soon shift focus to is Stagflation – High Inflation, Low Growth. This has been bubbling under the surface during the Covid Pandemic, however there are real signs now that Stagflation is becoming a growing issue as we head into the Winter months.

For further information on the energycrisis, help or support contact us on Tel. 024 76630 8830 or email @ sales@getsolutions.co.uk

#energycrisis