News

Insight is power

CfD’s Exemption for Electricity Intensive Users…

Contracts for Difference (CfDs) Exemption for Electricity Intensive Users…

As part of the UK Government’s climate change commitments, a number of schemes have already been implemented to encourage and incentivise decarbonisation. These schemes add cost to a consumers’ and business’ energy bills.

For Energy Intensive Industries – which in the UK include steel, aluminium, cement, ceramics, chemicals, paper, glass and industrial gas producers, these costs may distort their busines models and negatively impact upon their competitive position – in extreme cases, make it uneconomic to operate within the UK.

In an attempt to balance its decarbonisation and industrial objectives, and avoid losing key energy intensive businesses, the Government has already put in place a number of exemptions to help alleviate some of the cost for energy intensive users. However, this has come too late for the Steel Plant in Redcar and it’s closure pushes energy costs up the political agenda.

As a result, the Prime Minister has committed to bringing forward additional exemptions, specifically exemptions from the Renewable Obligation (RO) and Feed in Tariffs (FiTs). The UK Government is currently awaiting for European Union State Aid approval.

Exemptions currently in place:

| Climate Change Levy (CCL) | |

| • | Energy Intensive Industries that sign up to the Climate Change Agreement will be eligible for up to 90% relief from the Climate Change Levy. |

| • | Mineralogical and metallurgical processes became fully exempt from the CCL from April 2014 to put the UK tax treatment of highly energy intensive processes in line with tax treatments elsewhere in the EU. |

| Contracts for Difference (CfD) | |

| • | An exemption from future low-carbon electricity subsidy costs under CfDs beginning from 2015. The scheme exempts Energy Intensive Industries for up to 85% of the cost of CfDs on electricity bills |

| • | The relief is subject to State Aid approval but is expected to be approved shortly. |

| EU Emissions Trading Scheme (EU ETS) | |

| • | The Government compensates companies for the indirect costs to the Energy Intensive Industry from the EU ETS. |

| • | By October 2014 53 companies had been paid over £44m, mitigating around 65% of these costs. |

| Carbon Price Floor (CPF) | |

| • | Compensation for the Carbon Price Floor was introduced in summer 2014 |

| • | An exemption to the CPF from 2015/16 for fuels used to produce good-quality electricity in the CHP plant for use on site. |

| • | Together these measures are estimated to reduce the impact of carbon pricing (ETS and CPF) policies by up to around 80%. |

Exemptions to be implemented:

| Renewables Obligation (RO) | |

| • | Compensation from the costs of the Renewables Obligation and small-scale FiTs scheme from 2016/17 to 2019/20. |

| • | This scheme will compensate Energy Intensive Industries for up to 85% of the cost of the RO and small-scale FiTs on electricity bills. |

| Carbon Price Support (CPS) | |

| • | A cap on the Carbon Price Support (CPS) rate at £18 a tonne of CO2 from 2016/17 through to 2020. |

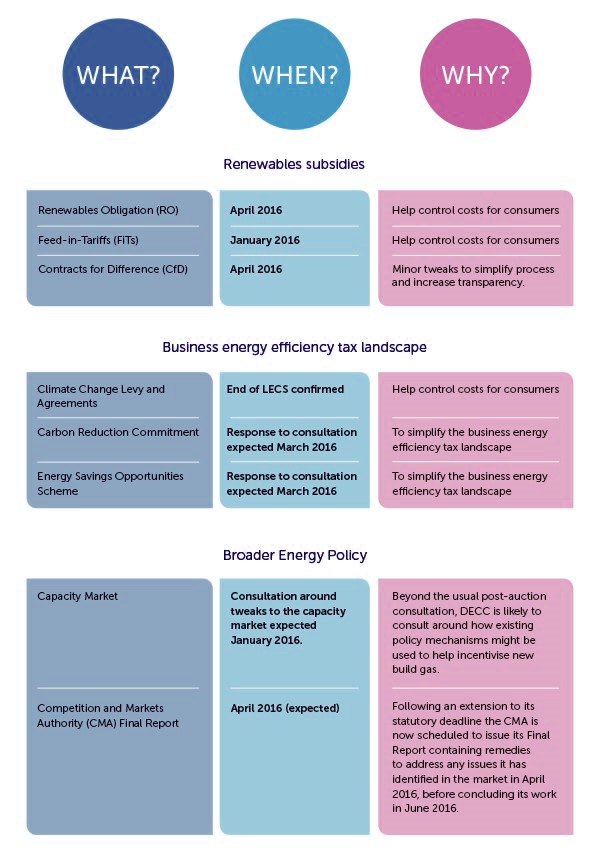

At a glance – Forthcoming Energy Policy and Regulatory Change

image and content supplied by SSE Business Power.

image and content supplied by SSE Business Power.