News

Insight is power

Energy Market Update for July 2016

A Special Post Brexit Energy Report

As the dust starts to settle from the result of the ‘Brexit’ vote, we are now starting to see the potential implications of the outcome. Opinion polls leading towards the referendum showed a clear lead for the remain camp, pushing a notable bookmaker to offer odds of 1/8 that the UK would decide to remain in the European Union on the morning of the vote. It is clear that the result sent ripples around the world’s financial markets.

The political implications are also being felt, with the Conservative Party seeking a replacement for Prime Minister Mr David Cameron, Labour Leader Mr Jeremy Corbyn under pressure to resign from his position and Nigel Farage stepping down from UKIP. This uncertainty and what ‘Brexit’ means for the UK initially affected banking stocks such as Barclays Plc and Lloyds Banking Group Plc and impacted on the British Pound, with Sterling falling against the US Dollar. Resultantly gas prices sharply increased with many Price Matrices being pulled on the Friday.

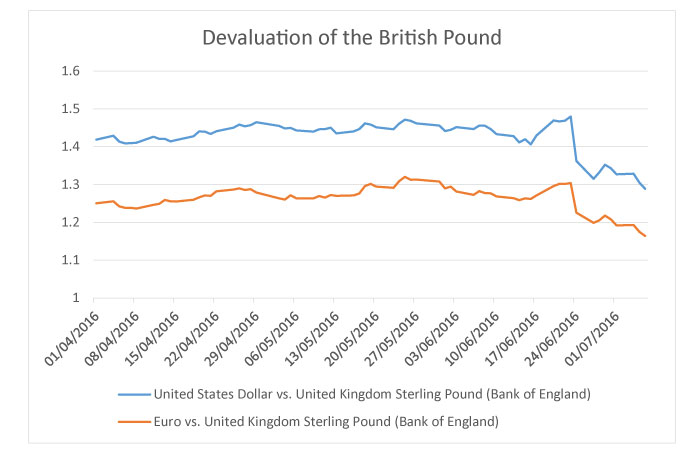

It is fair to say that once the markets digested the news of the vote and had time to act rationally, markets recovered will enough to claw back the losses of the previous days. The world waited in anticipation to the words of Mr Martin Carney, Governor of the Bank of England on Thursday, as his important words were needed to steady the markets. With a clear sign of a resurgence in expansionary monetary policy, hinting at a cut in interest rates in the summer and a rollout of quantitative easing. Markets rebounded whilst he was making his speech, as essentially they are trading with cheaper money. A side effect of quantitative easing is devaluation, and since June 23rd, the British Pound has lost ground against the US Dollar and the Euro, which can be seen on the below graph:

This influenced UK Gas Prices – due to a fall in the British Pound, imports from the continent increased, whereas exports to the continent became cheaper. As we import a significant amount from the continent, our Gas prices therefore increased, which led to suppliers initially pulling their prices until they could keep pace with the opening volatility.

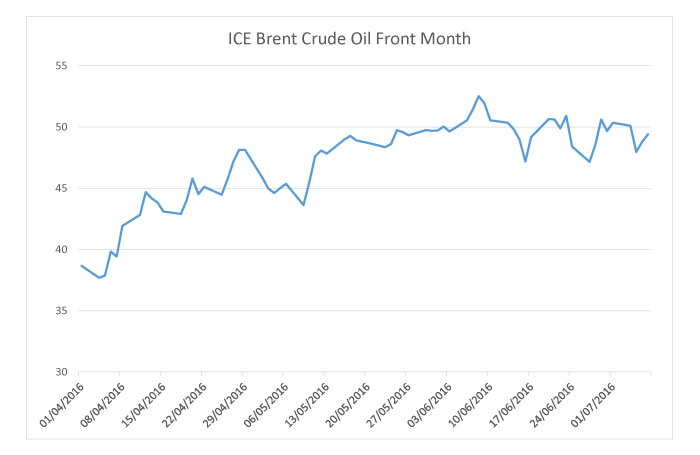

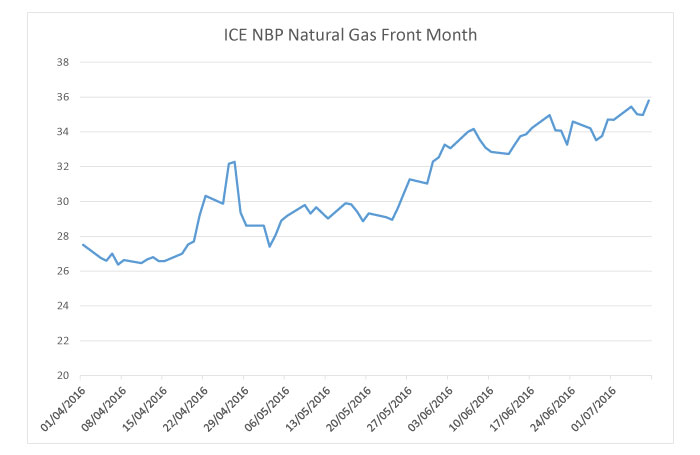

In truth, gas and electricity prices have been rising for some time, as it is directly linked to Oil Prices – recently the Saudi Energy Minister and the Secretary General of OPEC announced that the global market was heading towards a balance triggering a boost for commodity that has risen by 80% since its low point in February. We can see on the below graphs, how both the Gas and Oil Prices have evolved since April:

At this point it is hard to envisage what is going to happen next with the uncertainty within the Political sphere, as we step towards finding a new Prime Minister who can lead the UK through these uncertain times. Perhaps the biggest hurdle is to steady the UK Economy and avoid a possible recession, Chancellor Mr George Osbourne is looking to cut UK Corporation Tax to 15% by 2019 to attract more overseas investment.

The next few weeks and months will prove to be incredibly unpredictable, it remains to be seen if Gas and Electricity prices will continue to rise further, but it may prove better to expect increases in the short term. During such periods of unpredictability, the timing of gas and electric procurement is more important than ever and this in conjunction with group buying power and expert industry knowledge is key to securing key best possible rates.

To protect your utility costs from fluctuating markets, contact us